Forex trading is often mentioned as a feasible option for making money online. A thorough understanding of forex trading can help make an educated choice. We will look closer at it to determine if forex trading is as suitable as people sometimes say. Read also

What is trading forex?

Changing currencies in and out of exchange to take advantage of changes in their value is known as forex trading. Let us say you require euros to arrange a trip to Europe. At a specific rate, you convert your dollars into euros. You can convert those euros back to dollars at a profit if the euro’s value rises against the dollar in the future. That is the fundamental concept of forex trading.

How Do You Trade Forex?

Currency pairs, like the euro against the United States, which pits the euro against the US dollar, are the center of forex trading. You always deal in pairs when trading forex, purchasing one currency and selling another. Brokers act as intermediates between traders and investors, providing platforms with current information, charts, and tools to aid decision making.

The Attraction of Trading Foreign Exchange

There are various reasons why forex trading has a unique appeal:

High Level of Availability:

The world most liquid market is the currency market, so you may acquire or offer almost anytime without having to worry about not finding a buyer or seller.

Convenience and Accessibility:

Anyone with a web browser can trade forex five days a week, from any part of the world. It is, therefore, practical for people with hectic schedules.

Possibility of Large Returns:

Forex trading has the potential to produce significant profits when done correctly, but there is a considerable risk involved.

Risks Associated with Trading Forex

There is an excellent chance of making money, but there are also risks:

Volatility of the Market:

Forex markets are known for their extreme volatility, as prices can change quickly due to various events, political developments, and the publication of economic data.

The drawbacks of Strain:

Spread is a key component of currency trading that allows you to trade more than the amount in your trading account. Profits may rise as a result, but there is also a chance of severe losses.

Broker Risks:

Choosing a reliable broker is important. The poor execution strategies or hidden fees used by certain brokers could affect your trading results.

Elements Affecting Profitability

Research and Market Understanding:

It is important to updated with world events and economic data. Knowledge increases one’s ability to make wiser decisions.

Trading Methodologies:

The secret is to create and follow a carefully planned trading plan. Technical analysis, fundamental analysis, or a mix of the two may be used.

Risk Control:

Long term success depends on efficient risk management strategies, such as placing stop loss orders and never risking more than a small portion of your account on a single trade.

Forex Trader Types

Day Traders:

These traders try to profit from temporal market movements by opening and closing positions in a single trading day.

Traders on the swing:

Swing traders are traders who take positions for a few days or weeks in an attempt to make money from transitory trends.

Trading positions:

Position traders adopt a long term strategy, keeping positions open for months or even years in response to long term economic forecasts and trends.

Creating a Trading Strategy for Forex

A sound trading strategy can distinguish between success and failure:

Establishing Objectives:

Decide what you hope to gain from your trade, whether a specific rate of return or the development of your trading abilities.

Formulating an Approach:

Create a plan based on your objectives and level of risk tolerance. Fundamental analysis, chart patterns, and technical indicators may all be used in this.

Assessing Achievement:

Review your financial activities on a regular basis to see what is working and what is not. This will help you gradually improve your plan.

Often Used Forex Trading Techniques

Scaling:

Making numerous little agreements to profit from minute price swings is known as scalping. Day traders often employ it and call for swift decision making.

Trend Traders:

This tactic involves identifying and following market trends. It may be helpful for both long term and short term traders.

Trading in the range:

Trading within a range entails determining essential levels of support and resistance. This is helpful in marketplaces without an identifiable trend.

Resources and Tools for Forex Traders

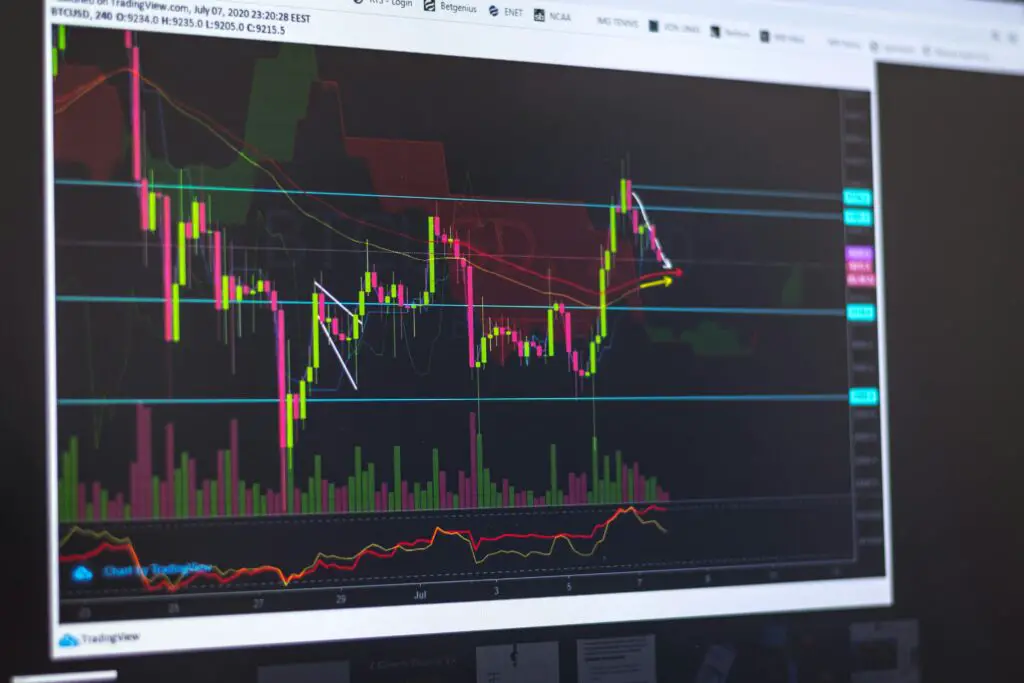

Tools for Technical Analysis:

These consist of oscillators such as the RSI, moving averages, and charting software.

Resources for Fundamental Analysis:

Traders can use economic calendars, news feeds, and information on important economic indicators to stay updated about events that could move the market.

Journals of Trading:

Maintaining a thorough record of your trades will help you spot areas for development and offer insightful information about your trading patterns.

Forex Trading Success Stories

Numerous accounts exist of people who have achieved substantial financial gains by forex trading:

Popular Forex Traders:

In the currency market, traders such as George Soros and Stanley Druckenmiller have amassed billions of dollars.

Actual Success Stories:

Many retail traders have also attained success, often due to disciplined tactics and ongoing education.

Typical Errors to Stay away of

Trading too much:

Excessive trading frequency might result in needless losses and elevated levels of stress.

Neglecting Risk Management:

One major reason traders lose money is that they need to manage risk better. Never take on greater risks than you are able to lose, and always utilize orders for stop loss.

Allowing Feelings to Affect Trading:

Emotional trading can result in impulsive decisions and significant losses. Adhere to your plan and maintain your discipline.

Is Trading in Forex Good for Everyone?

Only some people are suited for forex trading. It needs:

Proficiency:

It is important to have a solid understanding of both technical and fundamental market analysis.

Time Dedication:

Updated with market news and lifelong learning are essential to trading.

The ability to bounce back psychologically:

It is important to be able to deal with stress and losses without allowing them to control you.

Conclusion

Forex trading has the potential to be very rewarding, but it also has a high risk and demands a significant amount of time and investment. You may improve your chances of success by learning more about trading, creating a sound trading strategy, and controlling your risks well. However, it is essential to remember that not everyone will find long term success or suitability in forex trading.